All Categories

Featured

Table of Contents

Choosing to invest in the genuine estate market, stocks, or various other standard sorts of assets is sensible. When deciding whether you need to invest in recognized investor opportunities, you should stabilize the trade-off you make in between higher-reward potential with the absence of coverage requirements or regulative transparency. It should be stated that personal placements involve greater degrees of threat and can frequently stand for illiquid financial investments.

Especially, absolutely nothing below must be interpreted to state or suggest that previous results are an indicator of future performance neither need to it be translated that FINRA, the SEC or any kind of various other safeties regulatory authority authorizes of any of these securities. Additionally, when assessing personal placements from sponsors or companies offering them to approved capitalists, they can provide no guarantees shared or implied regarding precision, efficiency, or results acquired from any information supplied in their conversations or presentations.

The business needs to supply info to you through a document called the Exclusive Positioning Memorandum (PPM) that provides a more in-depth explanation of costs and threats connected with taking part in the investment. Rate of interests in these offers are just used to persons that qualify as Accredited Investors under the Stocks Act, and a as defined in Section 2(a)( 51 )(A) under the Firm Act or a qualified worker of the administration business.

There will certainly not be any kind of public market for the Rate of interests.

Back in the 1990s and very early 2000s, hedge funds were known for their market-beating performances. Some have underperformed, specifically during the financial crisis of 2007-2008. This different investing technique has an one-of-a-kind method of operating. Typically, the supervisor of an investment fund will certainly reserve a section of their offered possessions for a hedged bet.

How do I apply for Real Estate Development Opportunities For Accredited Investors?

A fund manager for an intermittent market may devote a part of the assets to stocks in a non-cyclical field to balance out the losses in instance the economy tanks. Some hedge fund managers utilize riskier techniques like using obtained cash to buy more of a property simply to increase their prospective returns.

Similar to mutual funds, hedge funds are expertly taken care of by career financiers. Unlike mutual funds, hedge funds are not as purely managed by the SEC. This is why they undergo much less scrutiny. Hedge funds can relate to different investments like shorts, alternatives, and derivatives. They can also make alternate investments.

What types of Passive Real Estate Income For Accredited Investors investments are available?

You might choose one whose investment viewpoint aligns with yours. Do bear in mind that these hedge fund money supervisors do not come economical. Hedge funds typically bill a cost of 1% to 2% of the possessions, along with 20% of the earnings which acts as a "efficiency cost".

You can acquire a possession and get awarded for holding onto it. Certified capitalists have a lot more possibilities than retail investors with high-yield financial investments and past.

Private Real Estate Investments For Accredited Investors

You must meet at the very least one of the adhering to parameters to become a certified investor: You need to have over $1 million net well worth, excluding your primary home. Service entities count as recognized capitalists if they have over $5 million in possessions under monitoring. You should have a yearly earnings that surpasses $200,000/ year ($300,000/ year for partners filing together) You have to be a licensed financial investment expert or broker.

Therefore, certified financiers have a lot more experience and money to spread throughout properties. Approved investors can seek a wider variety of possessions, but extra selections do not guarantee greater returns. A lot of capitalists underperform the marketplace, including certified financiers. Despite the greater standing, accredited financiers can make significant oversights and do not have accessibility to expert info.

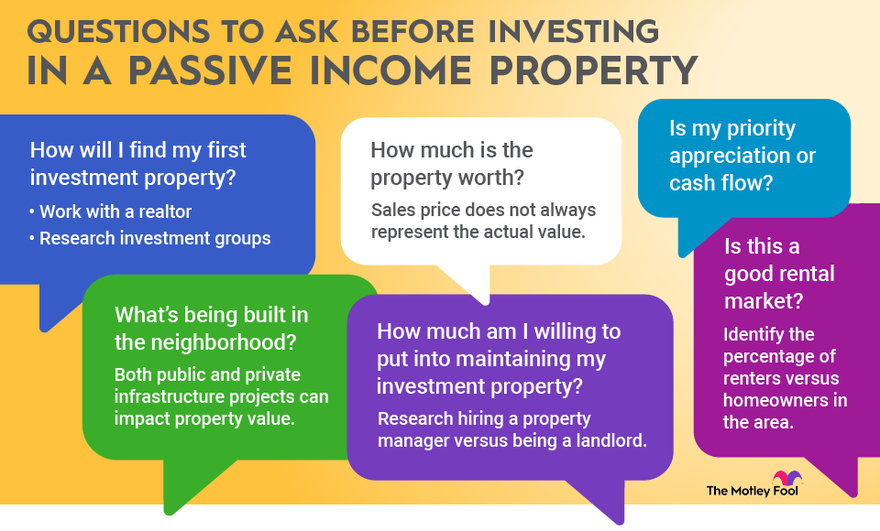

In enhancement, financiers can build equity via favorable cash money circulation and building admiration. Actual estate buildings need significant maintenance, and a great deal can go wrong if you do not have the ideal team.

How much do Real Estate Investment Partnerships For Accredited Investors options typically cost?

The enroller finds investment chances and has a team in location to deal with every obligation for the home. Property organizations merge cash from accredited capitalists to acquire residential or commercial properties aligned with well-known purposes. Exclusive equity property allows you buy a group of residential or commercial properties. Accredited capitalists merge their money with each other to finance acquisitions and property development.

Real estate financial investment trusts must distribute 90% of their taxable revenue to investors as returns. REITs permit investors to branch out quickly across many residential or commercial property classes with extremely little funding.

Where can I find affordable Accredited Investor Rental Property Investments opportunities?

The owner can decide to execute the convertible alternative or to sell prior to the conversion happens. Convertible bonds enable financiers to buy bonds that can end up being stocks in the future. Capitalists will benefit if the stock rate rises since convertible investments offer them more appealing access points. If the stock topples, financiers can decide against the conversion and shield their financial resources.

Latest Posts

How To Find Out Who Owes Property Taxes

Delinquent Real Property

Houses For Sale On Back Taxes